Vortic United Review: Vortic-united.com Shady Company

- - Can't withdraw your funds from this fraudulent company or broker?

- - Have they asked you to pay excessive withdrawal fees or to deposit more funds?

- - Or is there an excessive delay in processing your withdrawal?

- - Are they trying to push you into depositing more money with them even without withdrawing the one you've already put in?

It's a CONFIRMED scam broker/company, recover your stolen funds by filling out the form below and you will get a FREE Got-Payback consultation today:

You will be redirected to got-payback.com after clicking the image

Vortic United Review

-

Fund Safety

-

Customer Support

-

Regulation

Summary

With Vortic United, it’s not a matter of if but when this company will disappear with your investment. The fact that it is unregulated also denotes slim chances of legal intervention or compensation. We can bet that these are not the kind of risks any investors would want.

Vortic United poses as a valid institutional-grade trading services provider. On the contrary, it is a trading bot MLM crypto, Ponzi. Ponzi is a kind of scam that entices investors with promises of significant returns but instead uses money from newcomers to pay returns to earlier investors.

The online investment space is full of entities claiming to provide prodigy investment solutions to the public. While some of these companies are genuinely interested in boosting your returns, not all companies have such interests. So why not just nip the challenge in the bud? You may ask.

Unfortunately, regulators may find it challenging to identify and shut down Ponzi schemes, particularly ones that operate online and cross-border. Moreover, these scammers mainly operate online, making it simpler to reach a global audience and conceal their genuine identities. Furthermore, many MLM scams employ convoluted compensation plans and deceptive marketing strategies, making it challenging for victims to comprehend how the companies exploit them.

Additionally, these entities usually utilize pyramid structures which can be challenging to spot and prosecute. Furthermore, it is simple for con artists to launch new schemes or businesses, making it challenging for regulators to keep up with the fraud’s rapid evolution.

As things stand, the buck of keeping MLM fraudsters at bay stops with investors. Thus, you should exercise caution and conduct extensive research before investing. While dealing with legalized crypto companies or transparent forex brokers doesn’t exclude the risks, it minimizes the damage. Read the subsequent review for more insight.

Vortic-united.com Review

This company promises smart investment solutions by capitalizing on sophisticated trading strategies, such as order booking, on-chain metrics, and volume indicators. The company claims to have eight years of operational experience In crypto

markets. However, this is an outright lie, as the whois database indicates the entity registered its domain on 28 July 2022.

The benefits of investing with this company include a multi-signature secured account, portfolio management, trading insights, Hitech crypto trading, and an intuitive interface. If you want to invest with an MLM company, you should look elsewhere because Vortic United isn’t investing. Instead, it is redistributing your money amongst its members, at best.

Contact Details & Background

Although this entity has not revealed its location, there is a high likelihood it is based in Germany. Analytics from SimilarWebs trace the company’s traffic to Germany, Kyrgyzstan, and Bangladesh. Also, Jensen Robels, the alleged company’s founder, claims to be of German origin and a Switzerland domicile. This explains the misspellings on the entity’s website. Robels appears to be pals with Anthony DeLoatch, a serial Ponzi promoter in the US. As the saying goes, “birds of feather…,” we can conclude that the two ascribe to similar tendencies- investment ruses.

However, the business has no information regarding its registration. Vortic United company’s number is not registered under the Securities Exchange Commission (SEC). Registering with financial regulators ensures companies file periodic audited financial reports. It also proves that companies fund withdrawals from external revenue.

A lack of a telephone or email address suggests this company operates anonymously. There is nothing that you can use to track it down. So what happens when the so-called investment hits the fan?

Vortic United Deposit & Withdrawal

Since the company claims to offer crypto trading services, it only accepts crypto deposits, specifically in USDT. As you may know, crypto deposits aren’t the best for depositing. Besides being untraceable, you can’t reverse the transactions.

To be on the safe side, check that the company you are investing with(besides being legit) accepts traditional payments, such as credit cards and bank transfers, alongside digital ones.

Credit cards allow investors to view the funds’ recipients and file for a chargeback. This also means they can take legal action if necessary.

Investment Plan

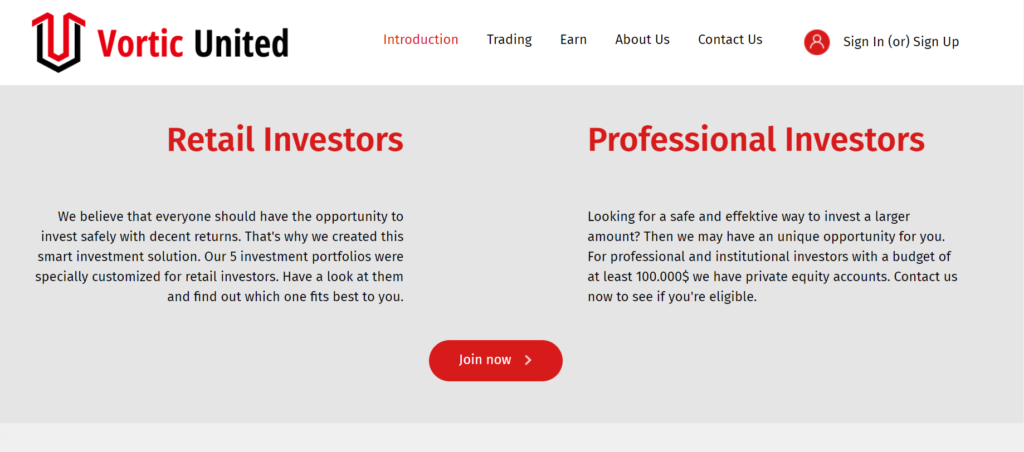

Vortic United has four investment plans. The first, portfolio A, requires a minimum deposit of $100. Next, portfolio B requires investors to deposit $2500. Portfolio C has a minimum deposit of $10000, and the compounding portfolio has a deposit threshold of $ 5000. Professional and institutional investors can also open private accounts with a minimum of $100000.

Additionally, the company offers eleven affiliate ranks. Investors should deposit at least USDT 50. Likewise, those in agent rank must deposit USDT 100 and convince recruits to invest a minimum of USDT 1000. Those in the partner rank deposit a minimum of USDT 200 and persuade recruits to invest USDT 5000. Operator rank members must deposit USDT 500 and their recruits USDT 25K. For the manager rank, individuals must pay at least USDT 2000 and their recruits USDT 80K.

Likewise, director affiliates must pay a minimum of USDT 8000 and their sign-ups USDT 200K. As for the president rank, affiliates pay USDT 10K while their recruits deposit USDT 500K. The ranks go on with the highest one, diamond, requiring affiliates to deposit 150K and their sign-ups to deposit 30M.

Vortic United Compensation Plan

Vortic United pays referral commissions via a unilevel compensation structure. You can identify bulks of investment fraud just by glancing at their offer.

Portfolio A affiliates earn a commission of 0.8 percent for 46 weeks. Similarly, portfolio B members get a 1 percent commission for 40 weeks. Next, the C and compounding portfolios get 1.2 and 1.6 percent commissions, respectively.

Any amount close to 1 percent daily is undoubtedly a fraud. That much revenue cannot be generated for clients by a genuine business. Again, this market is volatile and unpredictable, so no one has been able to foresee the financial markets. Avoid any company making any guarantees, implicitly or otherwise.

Vortic United is making unreasonable monthly returns on investment promises of up to 32 percent. Does this ring a bell? Well, Bitconnect Fraud, the notorious company, promised about 30% each month only to scam many investors. And yes, if a company promises what seems too good to be true, ditch them and find a legit but realistic one.

Regulation

BaFin oversees the regulation of securities in Germany. Nevertheless, there is no proof that Vortic United has registered with BaFin or any other financial regulator. Vortic United is committing fraud as it does not give the services it purports to offer and operates without the authorization of the respective oversight agency.

There are numerous risks in dealing with unregulated companies. Before we even get there, you should know that investing with MLMs (legal or not) is not as rosy as they would like you to believe. First, earning worthwhile profit is challenging. While many people join MLMs hoping to make money, they later realize this is challenging. This is due to the intricate payout structure and the requirement to acquire new members.

Secondly, with scam MLMs, you are under constant pressure to onboard new members. What happens when you succumb to pressure? You may be no better than the company, taking advantage of friends and family members.

Lastly, you have no one to turn to when your investment goes down the drain. This is because a lawless company is not answerable to authorities. Subsequently, you cannot get legal redress or compensation for your losses. Suffice it to say, so much is at stake here.

Our Take

Not every company promising you a passive investment opportunity is genuine. With Vortic United, it’s not a matter of if but when this company will disappear with your investment. The fact that it is unregulated also denotes slim chances of legal intervention or compensation. We can bet that these are not the kind of risks any investors would want.

In online investment, the least you can do is verify an entity’s regulation. In a similar line of reasoning, the most you can do is mitigate your risks. One way to do this is to ensure you only invest with legalized crypto companies or transparent forex brokers. This guarantees that if things go awry, as they always do, the regulators cover you.